"Wealth Creation is easier than you thought… "

Who doesn’t want to be rich, to have control over finance? Who doesn’t want to stay financially future-ready?

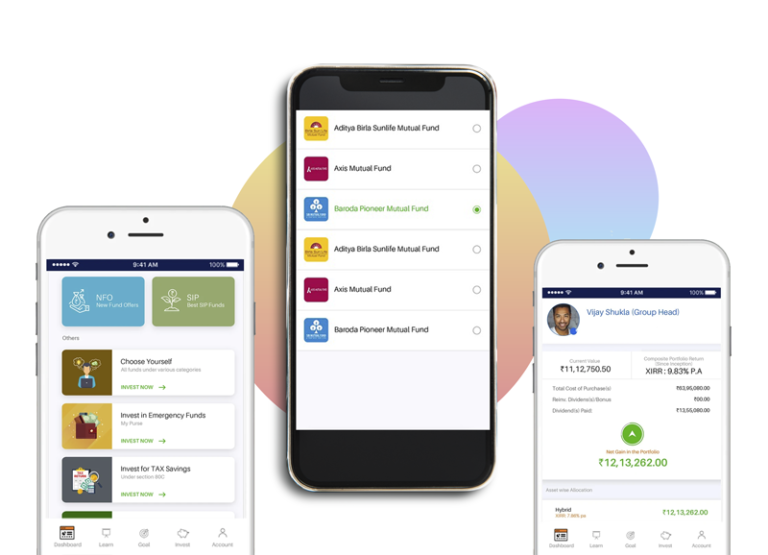

Put in the simplest sense, your desire to be well off, be financially strong and ready for cloudy days, to command respect need more than sufficient funds. Wealth creation is the answer to all the above. Through mutual funds you can create wealth by a technique called ‘Averaging’ and you can also minimize the market risk factor. It is generally achieved through 'Systematic Investment Plan (SIP)' and 'Systematic Transfer Plan (STP)'.

A SIP or STP investment over a long period of time can make you financially strong and independent. To sum up, you can make your money work for you.

Mutual Funds

A general guidance for investors

It is a rather inexpensive way for any investor to get full-time Professional Management to make and monitor investments.

Diversification plays the role here. By owning shares in a mutual fund instead of owning individual stocks or bonds, your risk is spread out and hence much less.

Economies of Scale applies here as a mutual fund buys and sells large amounts of securities at a time, thus lowering the transaction costs than what you would pay buying as an individual.

Liquidity is super smooth with mutual funds. Just like an individual stock, a mutual fund lets your shares be converted into cash at any time.

Since most of the companies have their own line of mutual funds, buying a mutual fund is easy and the minimum investment also stays small.