The Journey of Seeman Fiintouch

Since its inception, Seeman Fiintouch LLP moved with the aim to inspire people to save for their future and help to identify the right handles for investment. We want to cater to all possible financial needs under one roof. Savings and investment are two major decisive factors in a person’s life and Seeman Fiintouch LLP strives to ignite the urge within an individual to save and invest ensuring the best return. To sum up, we fortify our clients’ finance.

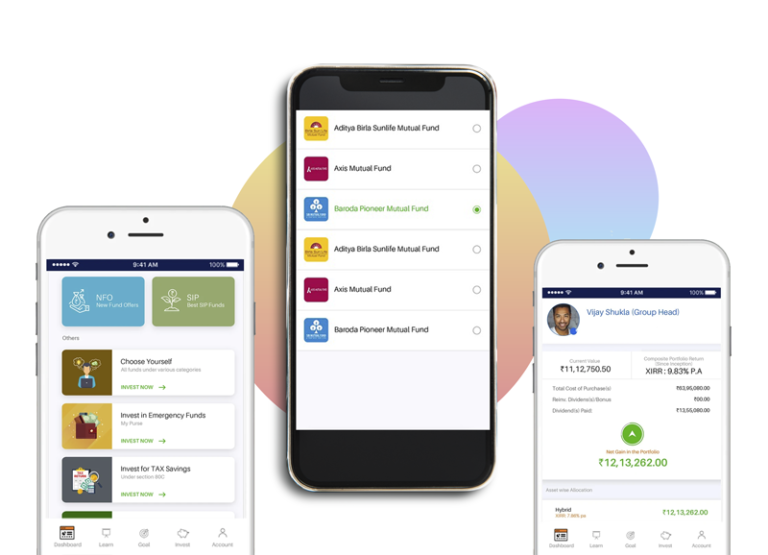

We are one of India’s fastest-growing Mutual Fund Distribution companies. At the same time, we are proudly one of the few youngest and most preferred by 1000+ happy families across India for the last 15 years.

With the inflation and prices of daily used commodities shooting high and uncertainty in the professional arena especially after the pandemic, we at Seeman Fiintouch LLP understand the challenges that the commoners face nowadays and feel their pressure which is mostly psychological. We intend to stay them prepared by providing a One-Stop financial solution thus,

To build up a financially strong individual out of every person who trusts us with their finance

To empower our investors

To make them financially knowledgeable and help them make the right financial decisions

We want to reach out and hold the hand of our clients to lead them on a long and prosperous journey in life. We, along with our clients, want to achieve all our dreams by staying strong, going steady and mapping long.

Wealth Creation

Wealth creation is the accumulation of income over a given period of time.

Do you keep your money locked up in a vault? Of course not . While financial products like real estate, gold, etc generates wealth but it takes lot of time and effort , also lacks liquidity . On the other hand , business as an asset class is a great opportunity that allows natural growth and stability. Now you might be thinking is it that simple to start a business ? No it is not , but it is very simple to invest in those successfully running businesses . In that way, Over a period of time you can generate wealth passively and more importantly you can withdraw the investment as per your needs.

Wealth Protection

Wealth protection is the efficient management of all personal assets.

In order to protect your wealth, follow a "spread it as you build it" approach. The strategy is to disperse and diversify your wealth across various asset classes and categories.

Another way to protect your wealth is to get insurance policies, which will not only protect you but also save on taxes and act as a financial tool in times of need.

The insurance company, then holds an umbrella of financial protection for the policy holder . God forbid If something were to happen to the policyholder, the insurance company will provide a financial safety net to the family.

That way you can save your hard grown wealth turn into Zero overnight .

Ashis Kumar Dey

(CFP,MFD, Financial Coach ) Completed his education as B.Com (hon.) University of Calcutta.

Certified Financial Planner -

Nism -V A ( NISM )

Started his journey with SBI Life Insurance back in 2005. During his initial days Mr. Dey realized the importance of proper guidance that was not available at that point of time.

He started a new journey with Mutual Funds Distribution & Equity with the vision to guide people to avail the right vehicles to reach their life goals smoothly and successfully.

His organization Seeman Fiintouch LLP (prev. Seeman Advisors) today takes care of 1000+ Financially happy & satisfied Families .